Important updates have been announced by the Government for supports aimed at employers, employees and self-employed people.

Covid-19: An Employers Guide (Employers)

The Covid-19 pandemic has thrown up many questions for employers and created challenging situations for employees. This Enterprise Ireland Employer HR guide gives employers some guidance around the key issues facing them from a HR perspective including remote working, employer obligations, change of working hours and employee well-being. Click HERE to download the Employer HR guide.

As further guidance, Enterprise Ireland have developed a Covid-19 resource hub on Enterprise Ireland eiLearn website. You can access relevant and daily updated articles, webinars and news at www.eilearn.ie/covid-19

National Covid-19 Income Support Scheme

COVID-19 National Wage Subsidy Scheme (Employers)

The COVID-19 Wage Subsidy is a scheme which allow employers to pay their employees during the current pandemic.

Introduced on March 26th, this scheme was further updated on the 15th April with revised benchmarking for refunds.

Employers can be refunded up to 85 percent of an employee's wages.

The employer is expected to make their best efforts to maintain as close to 100% of normal income as possible for the subsidised period.

NB: This payment replaces the Department's Employer Refund Scheme announced on 15th March, and any business that received refunds under the current scheme do not need to re-apply. The Revenue Commissioners will contact them directly to confirm that they meet the conditions for this new scheme. To find out more, please click here

COVID-19 Enhanced Illness Benefit (Employees and Self-Employed)

If you have been diagnosed with COVID-19, or are medically certified to self-isolate as a result of COVID-19, you can apply for Illness Benefit for COVID-19 absences paid at a rate of €350 per week. You can apply for this whether you are an employee or if you are self-employed.

COVID-19 Pandemic Unemployment Payment (Employees and Self-Employed)

If you’re eligible, the quickest and easiest way to apply for the Covid-19 Pandemic Unemployment Payment (PUP) is online at www.myWelfare.ie

Please visit www.gov.ie for more information on the Pandemic Unemployment Payment.

To request a form and apply by post please email forms@welfare.ie.

NSAI Guidelines for the Workplace

The National Standards Authority of Ireland (NSAI) have recently published two guides, to help employers.

The Retail Protection and Improvement Guide helps retailers manage business continuity during the COVID-19 emergency.

The guide outlines preventative measures businesses can take to help prevent the spread of the CoronaVirus and addresses risks to both workers and the public.

Download this NSAI guide here

The Workplace Protection and Improvement Guide consolidates practical guidance on how to manage business continuity during the COVID-19 pandemic. It addresses risks to both workers and the public.

The Return to Work Safely Protocol is designed to support employers and workers to put measures in place that will prevent the spread of COVID-19 in the workplace, when the economy begins to slowly open up, following the temporary closure of most businesses during the worst phase of the current pandemic.

The Protocol should be used by all workplaces to adapt their workplace procedures and practices to comply fully with the COVID-19 related public health protection measures identified as necessary by the HSE. It sets out in very clear terms for employers and workers the steps that they must take before a workplace reopens, and while it continues to operate.

A high-level consultative stakeholder forum, under the aegis of the Labour Employer Economic Forum, will be established. This forum will include membership from the various bodies with responsibility for health and safety at work and for public health more generally. The forum will allow for ongoing engagement at national level on implementation issues in light of evolving public health advice and other factors.

The Return to Work Safely Protocol, is the result of a collaborative effort by the Health and Safety Authority (HSA), the Health Services Executive (HSE) and the Department of Health and the Department of Business, Enterprise and Innovation.

We recognise that companies may require guidance on how to best plan for a reintegration of employees back into the workplace. We have developed this Return to the Workplace Guide to help you understand and consider the specific HR challenges you need to address to re-establish your operations and manage the reintegration of employees back into your place of work.

In particular, the guide focuses on your role as an employer in ensuring the continued health and safety of workers and provides guidance on how you can safely reintroduce employees back into the workplace, building on the guidance already communicated within the HSA Return to Work Safely Protocol. This document is also intended to help you review your resource planning requirements and provides options to consider in relation to the restructuring of roles and responsibilities whilst managing a phased return to work.

Return to Work Safely Protocol

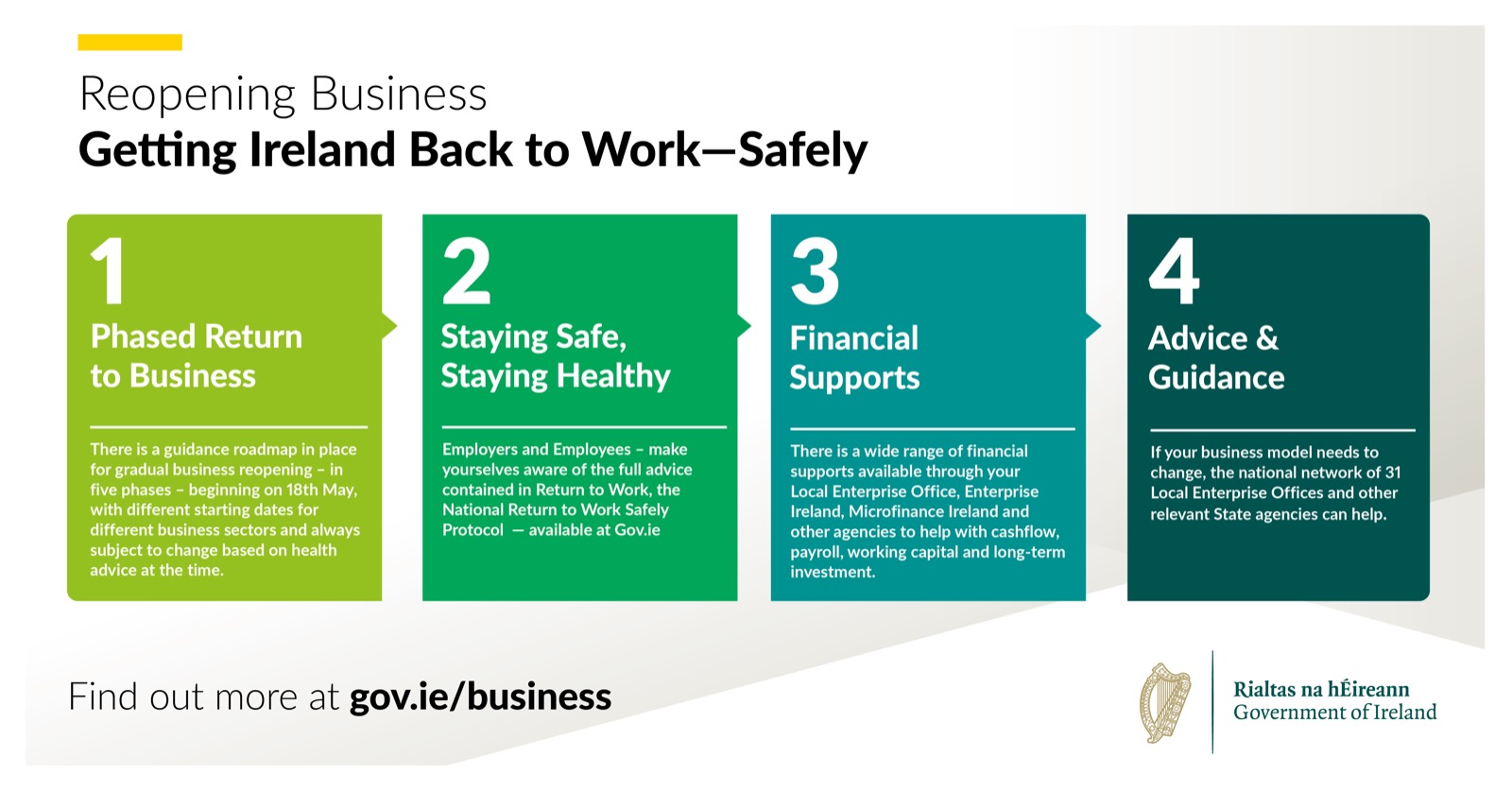

The COVID-19 pandemic has disrupted our communities and our businesses, but now – thanks to your patience and sacrifice – we’re looking ahead to a careful, phased reopening of our country. National and local government, State agencies and representatives of employers and employees have worked together so that businesses can resume, safely and effectively.

Click here for the 4 pathways to help get your business back on its feet.