Micro Finance Ireland (MFI) provide small loans through the Government’s Microenterprise Loan Fund. The purpose of the fund is to help start-ups and established businesses to get the finance they need for their business

What is a micro-enterprise? It is simply a small business (including a self-employed person) with fewer than 10 employees and an annual turnover of less than €2m. MFI help these businesses by providing unsecured business loans of €2,000 to €25,000 for commercially viable proposals. Sole Traders, Partnerships & Limited Companies are all eligible to apply.

MFI can consider applications from businesses that may have been declined a loan from their Bank. MFI look at each application and base our decision on the viability of the business and your ability to repay the loan.

Log on to https://microfinanceireland.ie/ for full information on all their loan packages.

Local Enterprise Office Kilkenny can support you to make your loan application to MFI, businesses can avail of one to one mentoring support to develop their application and projected accounts for the loan application. Contact Aileen McGrath or Catherine Hennessy at Local Enterprise Office Kilkenny for more information on MFI for your business.

Email: Aileen.McGrath@leo.kilkennycoco.ie

Catherine.Hennessy@leo.kilkennycoco.ie

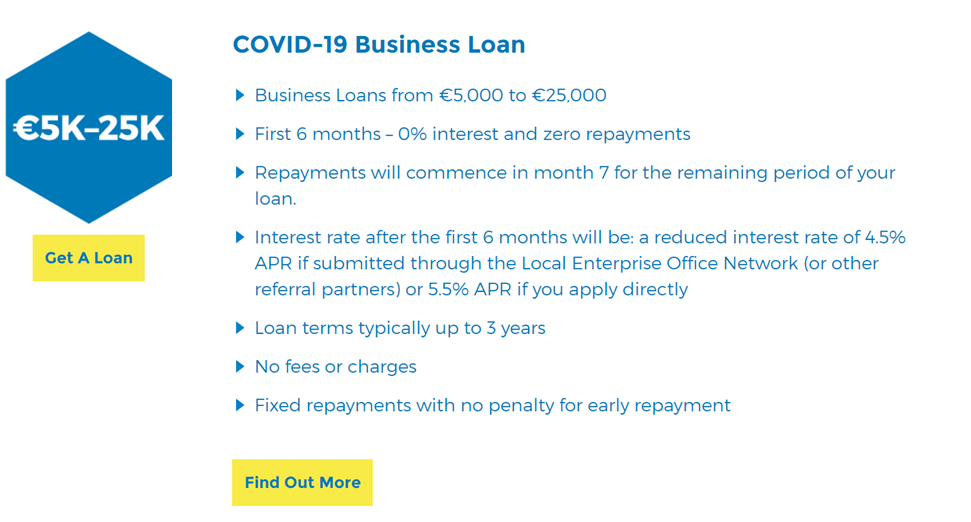

COVID-19 Business Loan

The COVID-19 Business Loan from Microfinance Ireland (MFI), in partnership with Local Enterprise Offices, is a Government-funded initiative to support small businesses through the current period of uncertainty.

It’s designed for micro-enterprises that are a) having difficulty accessing Bank finance and b) impacted, or may be impacted negatively, by COVID-19 resulting in a reduction of 15% or more in turnover or profit.

COVID-19 Business Loan Features

For Further Details Visit Microfinance Ireland Website